Germany, e-commerce and logistics

Germany has a booming e-commerce market and is a popular export market for British e-tailers.

Added to this, Germany’s excellent logistics infrastructure makes it an ideal destination for e-commerce trade.

But how much do you know about sending a parcel to Germany from the UK? Read on to find out about how best to deliver to places like Berlin, Hamburg, Munich, Cologne and more.

Why ship to Germany?

Germany has one of Europe’s strongest economies. With its large population and high internet penetration, it is also one of Europe’s strongest e-commerce markets.

With a population of 84.1million, Germany is the largest consumer market in the European union. The German economy is the third largest in the world is also the United State’s largest European trading partner. 1

- 90.4 billion Euro

- Retail e-commerce revenue in Germany

- Electronics

- Most popular online shopping category

[Stats taken from: www.statista.com/topics/5751/e-commerce-in-germany#topicOverview]

The e-commerce landscape

B2C e-commerce in Germany is skyrocketing with huge levels of growth year after year. While at the beginning of the 21st century, B2C online revenue in Germany grew from one to three million euros, by 2023 figures neared 85 billion euros and were estimated to reach over 88 billion in 2024 2.

Opportunities

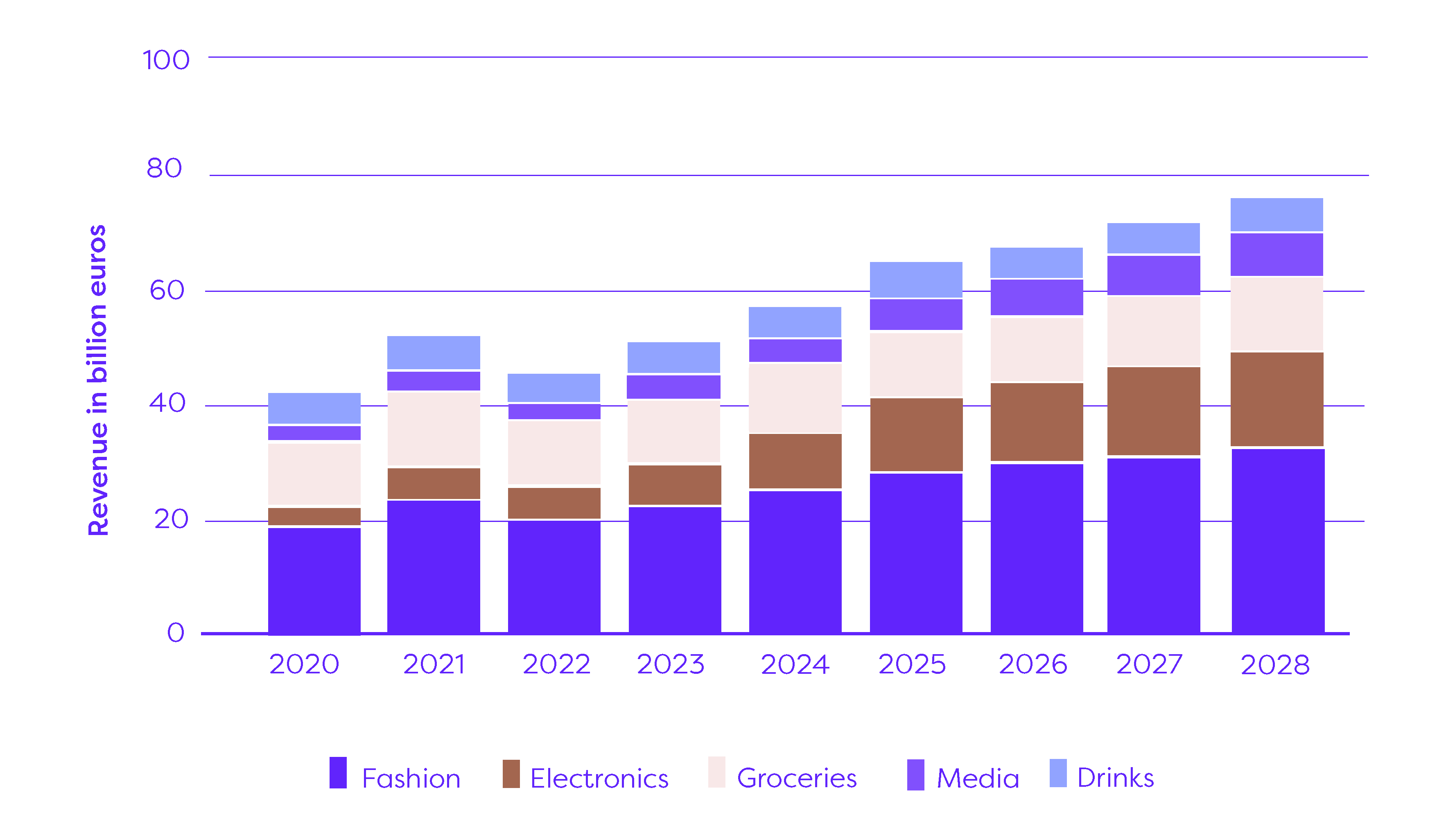

Certain products reign when shopping online in Germany. The most popular category when it comes to buying items on the internet is electronics. In Germany people are purchasing online frequently with over a fifth of Germans doing so several times a month. Forecasts suggest that online shopping is here to stay with the revenue of categories such as fashion and electronics expected to grow significantly.

Forecast of revenue development in e-commerce in Germany from 2020 to 2028, by segment

Logistics

Time and cost of shipping to Germany will be a big factor in people choosing to shop with you. The big concern for buying from the UK, however, is whether new trade agreements as a result of the UK leaving the European Union will impact this.

UK companies shipping to Germany will now need an EORI number from HMRC for both customs and VAT documents. You’ll also need customs declaration forms CN-22 and CN-23. On top of this, you’ll need to consider VAT and setting up an IOSS number. This is anelectronic declaration and payment VAT portal for distance sales of imported goods (with a value not exceeding €150).

You can familiarise yourself with the weights and prices of sending a package to Germany using our helpful shipping rates chart .

Keep in mind:

The German standard VAT rate is 19.0%. Germany also applies a reduced VAT rate of 7% to a number of goods and services. Temporary specific reduced VAT rates applied in the context of the Covid-19 pandemic from March 2020 to June 2022.

What our experts say:

“Germany is Europe's e-commerce leader offering a myriad of opportunities for international online retailers.”

Ben Bagnulo, CEO, SAMOS.